What is Bookkeeping and Why Is It So Important?

Bookkeeping is keeping a record of your finances and how they are organized. It’s your company’s money diary—where every penny going in, going out, and what every pound gets spent on is recorded.

Accurate and consistent bookkeeping isn’t just an administrative chore; it’s absolutely fundamental to the health, compliance, and success of any business, particularly in the UK. Here’s why:

Legal & Tax Compliance (HMRC)

This is non-negotiable. HMRC requires businesses to keep accurate records for tax purposes (including Income Tax, Corporation Tax, and VAT). Good bookkeeping ensures you can file accurate returns on time, calculate the correct tax liabilities, and avoid potentially hefty fines and investigations.

Understanding Financial Health

Bookkeeping provides a real-time (or near real-time) view of your business’s financial pulse. You can see if you’re making a profit or loss, track your cash flow, and understand exactly where your money is coming from and going to.

Informed Business Decisions

How can you set prices, manage costs, or plan for growth without accurate financial data? Bookkeeping provides the reliable numbers needed for budgeting, forecasting, investment decisions, and strategic planning.

Securing Funding

Whether you’re seeking a bank loan, attracting investors, or applying for grants, potential financiers will demand accurate and organised financial records. Clean books demonstrate financial stability and responsible management.

Effective Budgeting and Forecasting

Reliable historical data from your bookkeeping is essential for creating realistic budgets and financial forecasts, helping you plan for future expenses and revenues.

Performance Tracking

Good bookkeeping allows you to analyse trends over time. Which products or services are most profitable? Are expenses creeping up in certain areas? This analysis helps you optimise operations.

Simplified Tax Preparation

When tax season arrives, having well-organised records throughout the year makes preparing and filing your returns significantly faster, less stressful, and potentially cheaper if you use an accountant.

Error and Fraud Detection

Regularly reviewing your books can help you spot errors, duplicate payments, or suspicious activity quickly, preventing small issues from becoming major problems.

Common Bookkeeping Errors Small Business Owners Make

| Mistake | Why It’s a Problem | How to Fix It |

|---|---|---|

| Mixing personal and business finances | Makes tracking expenses and tax returns messy | Use a separate business bank account |

| Delaying data entry | Leads to forgotten transactions and errors | Keep records updated regularly |

| Not backing up records | Risk of data loss or non-compliance | Use cloud-based software with secure storage |

| Missing tax deadlines | Can result in fines or penalties | Set reminders or use automated systems |

Averting these everyday mistakes can spare you time, money, and plenty of frustration in the future.

Selecting the Right Bookkeeping Setup

Not all small businesses require the same kind of bookkeeping. It truly depends on your business size, industry, and amount of involvement.

Below is a quick comparison to guide you towards the decision:

| Setup | Best For | Pros | Cons |

|---|---|---|---|

| DIY (Spreadsheets or Manual) | Very small or just starting out | Free, full control | Time-consuming, higher risk of errors |

| Bookkeeping Software | Growing businesses, freelancers | Automation, real-time reports | Learning curve, still needs some oversight |

| Outsourced Bookkeeping Service | Business owners who want to save time | Expert support, stress-free compliance | Monthly cost, less control |

| Hybrid (Software + Expert Help) | Businesses that want the best of both worlds | Efficiency + professional advice | Requires finding a reliable provider |

If you don’t want to hire in-house staff but still want accurate, up-to-date records, hiring a service like Nomi’s bookkeeping solution might be the way to go.

What’s Really Included with Bookkeeping Services?

When you go with Bookkeeping for Small Business

, you’re not bringing on a number cruncher.

It’s having the whole system in place to keep finances stress-free, neat, and compliant.

Professional bookkeeping services include the following:

Daily Transaction Recording

Bank Account Reconciliation

Invoicing and Tracking Payments

VAT Return Preparation

Payroll Support (If Necessary)

Year-End Financial Statements

Real-Time Reporting Dashboards

Help with Making Tax Digital (MTD)

Features to Consider in Bookkeeping for Small Business

When considering applying bookkeeping software to small business, make sure you apply one which is business-oriented for small businesses.

Watch out for these features when selecting:

- Ease of useYou shouldn’t require an accounting qualification to work with your own software.

- Cloud-based accessSo you can keep an eye on your money from anywhere.

- Real-time reportingKeep your finger on the pulse of your cash flow.

- Bank and app integrationTo minimize manual entry.

- Automatic invoice creation and remindersSo you get paid promptly.

- MTD compatibilityTo remain HMRC compliant.

Instant Comparison of UK’s Most Popular Bookkeeping Software

| Software | Best For | Starting Price (per month) | Key Features |

|---|---|---|---|

| Nomi | Small businesses wanting full support | £10+VAT | Software + expert bookkeeping team, MTD ready, auto invoicing |

| Xero | SMEs with payroll needs | £14–£49+VAT | Invoicing, reporting, MTD ready |

| QuickBooks | Freelancers and small shops | £14–£30+VAT | Mileage tracking, automated categorisation |

| FreeAgent | Contractors, freelancers | Free with certain banks | Project tracking, time-based billing |

| Sage | Product-based businesses | £12–£33+VAT | Stock management, payroll options |

A Quick Recap - Bookkeeping for Small Business

Once your books are tidy, your entire business is easier to manage. You can do it yourself, pay for software, or utilize a full-service team like us, but what they all have in common is consistency and accuracy.

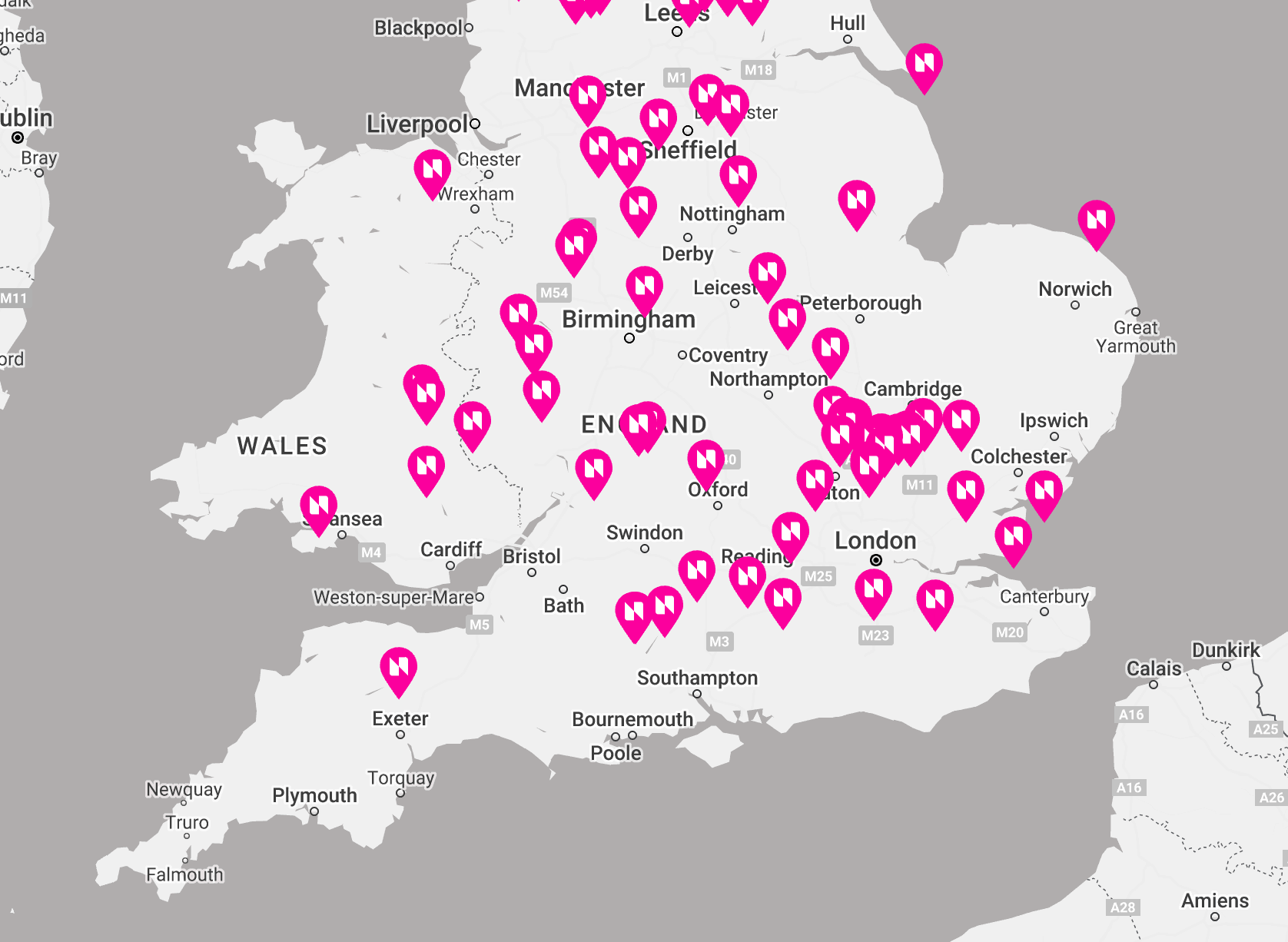

At Nomi, we provide expert bookkeeping for small business owners across the UK, helping them manage their finances with ease

Our combination of professional guidance and robust software is created to simplify your life—so you can do what you do best: operate your business.

How Nomi Makes Bookkeeping Easy for Small Businesses

- Software that does invoicing, receipts, and bank reconciliation all in one

- A UK-based team of experienced bookkeepers

- Monthly reporting so you’re always current

- Tax-ready reports for year-end

Tips for Keeping Bookkeeping in Check in a Growing Business

- Make all paperless – Use apps or scan receipts

- Book a monthly catch-up – Review cash flow and invoices

- Save for tax – Set aside VAT and income tax regularly

- Utilize live dashboards – Make informed decisions

- Have assistance when you need it – Don’t do it all yourself

How Bookkeeping Services Keep You Compliant

With Making Tax Digital now fully rolled out for VAT-registered businesses, digital record keeping is a legal requirement. Professional services ensure that:

- Your books are accurate and up to date

- VAT returns are filed on time

- You’re claiming the right expenses

- You don’t miss a filing deadline

Want to chat?

We'd love to hear from you.

Frequently Asked Questions

- What is the difference between bookkeeping and accounting?Bookkeeping involves the recording and classifying financial information, whereas accounting entails interpreting and analyzing the same data to assist you in making business decisions. Bookkeepers will make books accurate; accountants will utilize that information to make financial reports and tax returns.

- How much does bookkeeping service cost in the UK?Costs vary depending on the level of service. Basic small business bookkeeping can start from around £20–£30 per month if using software, but full-service solutions with expert support (like Nomi) may range from £50–£150 per month, depending on the complexity of your business.

- Is bookkeeping required for tax purposes?Yes. HMRC insists that you keep accurate and up-to-date bookkeeping records to back up your tax return and Making Tax Digital compliance. Good bookkeeping will also allow you to claim proper allowable expenses and avoid expensive penalties.

- How frequently do I need to update bookkeeping records?You should be updating your books weekly, or even daily if you are dealing with large volumes of transactions. Periodic updating helps you catch early signs of trouble, be in control of cash flow, and prevent panic towards the end of the season when taxes need to be prepared.

- Need bookkeeping to be done by sole traders in the UK?Yes. As a sole trader, you are still required to maintain proper records for taxation. You are requested by HMRC to account for income, claim allowable expenses accurately, and report Self Assessment on the basis of accurate records.