What Is Remittance Advice? Definition, Importance & Examples

A remittance advice is a simple document sent by a customer to a supplier, letting them know that a payment has been made. It acts as a notification and proof, helping both parties match payments to invoices and avoid confusion. Businesses of all sizes use remittance advice to keep their records accurate and up to date.

This document usually contains details like the payment amount, invoice number, and payment date. By sharing this information, suppliers can quickly identify which invoices have been paid, making their accounting process smoother.

Remittance advice can be sent in various formats, such as email, paper, or through online systems. Using remittance advice improves transparency and builds trust between businesses and their customers.

What Is Remittance Advice? Definition and Meaning

Remittance advice is a document sent by a customer to a business to notify them that a payment has been made. It serves as a proof of payment notification, helping businesses match the payment to the correct invoice and avoid confusion. Although it confirms that payment was sent, it is not the same as proof that the payment was received or cleared by the bank.

Typically, remittance advice includes details such as the payment amount, invoice number, and payment date. This information helps businesses keep their accounts accurate and speeds up the reconciliation process.

By sending remittance advice, customers improve communication with suppliers, making payment tracking clearer and more efficient for both parties.

Why Is Remittance Advice Important for Businesses?

Remittance advice is important for businesses because it helps suppliers easily match payments to the correct invoices, reducing confusion and errors. By issuing remittance advice slips, businesses provide essential payment details that streamline invoice reconciliation and improve payment-tracking accuracy. This ensures that both parties have a clear record of what has been paid and what is still outstanding.

Additionally, remittance advice acts as a notification that a payment is about to be made, supporting the payment process and fostering transparency between businesses and suppliers. It helps prevent disputes by clearly communicating payment information upfront.

Key benefits of remittance advice for businesses include:

-

- Ensuring accurate matching of payments to invoices

- Streamlining reconciliation and cash application

- Providing clear payment notifications

- Reducing follow-up queries and errors

- Enhancing financial transparency and trust between partners.

Information Included in a Remittance Advice

A remittance advice includes key information that helps the supplier understand which payment corresponds to which invoice. This makes it easier to match payments and keep accurate records. Here are the main details typically included in a remittance advice:

-

- Payer’s name and contact details: Identifies who made the payment.

- Payment date: Shows when the payment was sent.

- Payment amount: Specifies how much money was paid.

- Invoice number(s): Lists the invoice(s) the payment covers.

- Payment method: Indicates how the payment was made (e.g., bank transfer, cheque).

- Reference number or transaction ID: Helps track the payment in banking systems.

Including these details ensures clear communication between the payer and the supplier, reducing errors and speeding up payment processing.

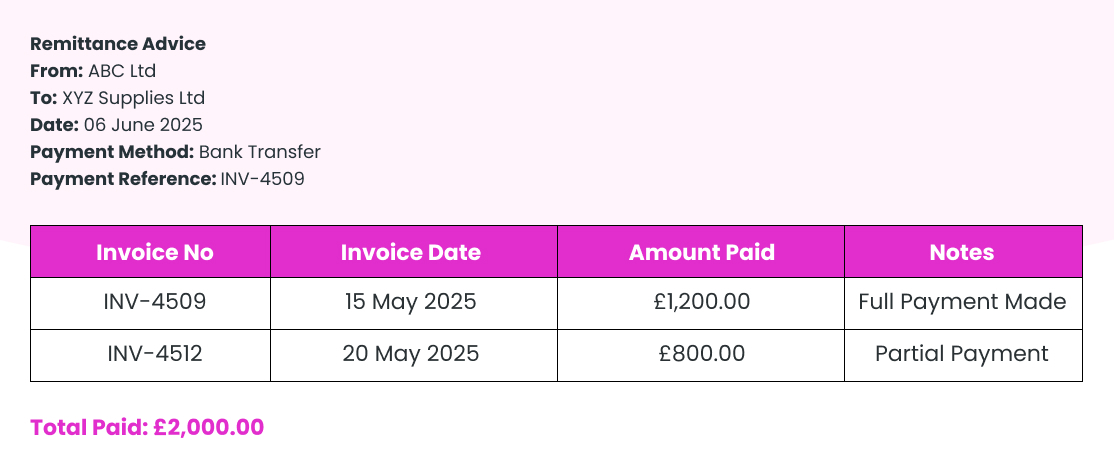

Remittance Advice Example: What Does It Look Like?

Remittance advice can be formatted as a simple letter, a table, or a professional template. For more detail, see the example below.

Remittance Advice

From: ABC Ltd

To: XYZ Supplies Ltd

Date: 06 June 2025

Payment Method: Bank Transfer

Payment Reference: INV-4509

| Invoice No | Invoice Date | Amount Paid | Notes |

| INV-4509 | 15 May 2025 | £1,200.00 | Full payment made |

| INV-4512 | 20 May 2025 | £800.00 | Partial payment |

Total Paid: £2,000.00

How to Create a Remittance Advice Template?

To create a remittance advice template, follow these simple steps:

-

- Add Your Business Details

Start with your company name, address, and contact number at the top. - Include Supplier Information

Mention the name and address of the supplier you’re paying. - Write the Payment Date

Clearly state the date the payment is being made. - Mention the Payment Method

Note how the payment was made, such as bank transfer, cheque, or online payment. - Use a Unique Payment Reference

Include a reference number to help track or confirm the payment. - Insert a Table of Invoices Paid

Create a table with these columns:-

- Invoice Number

- Invoice Date

- Amount Paid

- Notes (optional)

-

- Show the Total Amount Paid

Add a line below the table showing the full amount you’ve paid. - Leave a Space for Notes or Sign-Off

This can be used for any special comments or authorisation.

- Add Your Business Details

How to issue a Remittance Advice

To issue a remittance advice, you have two main options:

-

- Paper: If paying by cheque, send a printed remittance advice slip along with the cheque to notify the supplier.

- Electronic: For online payments, email the remittance advice with payment details like invoice number and amount.

Electronic vs. Paper Remittance Advice: Which Is Best?

Choosing between electronic and paper remittance advice depends on your business needs, but electronic remittance advice (ERA) generally offers more advantages:

-

- Speed and Efficiency: ERAs are delivered instantly via digital channels, speeding up payment processing and reconciliation, while paper advice can take days to arrive and requires manual handling.

- Accuracy: Electronic formats reduce human errors caused by manual data entry common with paper documents.

- Cost Savings: ERAs eliminate printing, postage, and storage costs associated with paper remittance advice.

- Security: Digital delivery provides better protection of sensitive payment information compared to physical mail.

- Easy Storage and Retrieval: Electronic advice is stored digitally, making it easier to organize and access when needed, unlike bulky paper files.

However, paper remittance advice may still be preferred in some industries or where digital infrastructure is limited. Overall, electronic remittance advice is the best choice for faster, more accurate, and cost-effective payment communication.

Want to find out more?

Book a free 30-day trial or talk to one of our advisor and see how our accounting software can help you manage staff, increase profitability and take your practice to the next level.

Can You Amend a Submitted CT600 Form with HMRC?

If you have submitted a CT600 Corporation Tax return and later find an error or...

Read More

What Features Should You Look for in Corporation Tax Software?

If you are a small business owner or an accountant, navigating the difficulty of corporation...

Read More

Final Accounts Filing Deadlines in the UK

If you run a business in the UK, you’ve heard about filing final accounts, but...

Read More