Nomi Product Update – 14/08/2023

It’s that exciting time again when we share the latest additions and refinements to the Nomi platform. Our team has been hard at work, focusing on your feedback and making the system even more seamless.

What’s new:

8936 – Self-assessment – Date of death: The date of an individual’s death has been added to the client profile to make it easily accessible.

8523 – Bookkeeping – Ledger reconciliation: Fixed an issue whereby reconciled items weren’t appearing within VAT returns when the Cash-basis was active.

2224 – Final Accounts – FRS105 Limited company accounts: We have improved the page loading speed of FRS105 accounts.

8932 – Self-assessment – Rent-a-room relief: We’ve automated the process for claiming rent-a-room relief within a self-assessment.

9208 – Bookkeeping – Credit note, ledger reconciliation: When a credit note was marked as paid partially, it was showing as fully paid. This issue has now been fixed.

7038 – Bookkeeping – EC acquisition of goods added to VAT type dropdown: When creating a supplier bill, you can now select ‘EU Purchase’ which will then add the item to the EC acquisition of goods section of your VAT return.

6269 – Bookkeeping – Ability to manually override discount: When creating a sales invoice, you can now override the discount amount instead of just being able to select a percentage.

7921 – Bookkeeping – Reconciling a bank transaction to the same bank: When within a specific bank account reconciling transactions, if you select the same bank account in the ‘Allocate To’ field, Nomi will present you with an error message.

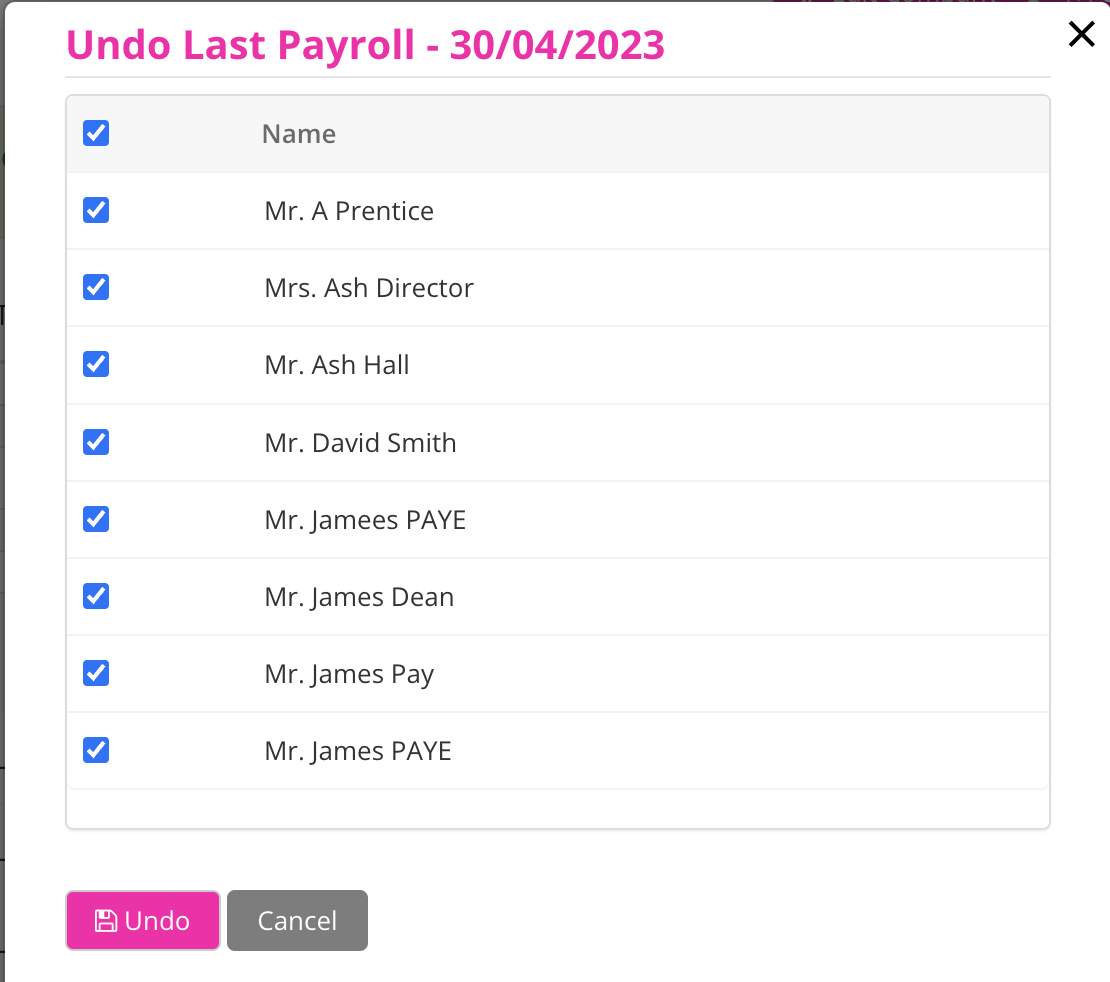

4996 – Payroll – Undo payroll for a single employee: When undoing payroll runs, you can now select to only undo the payroll for specific employees, ensuring you won’t accidentally change pay details of other employees. Simply select ‘Undo Payroll’ and you’ll be presented with a list of employees which can be undone.

Highlight of the Week

Every week, we’ll spotlight a feature or update that we believe can make a significant difference in your workflow. This week’s highlight is:

Automated payroll for directors: Consistency is key, especially when it comes to director payroll. We’re excited to introduce our new automated payroll feature tailored explicitly for directors. Recognizing that director salaries are often set at the tax-efficient national insurance threshold, we’ve optimized Nomi to handle such regularities.

With this innovative feature, say goodbye to the monthly grind! Nomi not only runs the payroll but also efficiently files it with HMRC. But that’s not all! Payslips are automatically dispatched, and the necessary journal entries? Consider them posted in the bookkeeping.

Automate, streamline, and elevate your payroll process with Nomi. We’re here to save you time and keep things running smoothly.

Looking Ahead

We’re always looking to the future, and here’s what’s on our radar for the coming weeks:

Our focus is on user experience and stability. That means we’re still focusing on reducing bugs, improving speed and making small tweaks to the software that you, the user, are requesting. Thank you all for your feedback recently, it’s really helping us move Nomi forward.

Feedback

Your feedback helps shape the future of Nomi. If you have any suggestions or comments on these updates or anything else, please feel free to reach out. You can contact us at support@nomi.co.uk or join our Facebook community.

That’s all for this week! Remember to check back next Monday for more product updates. Until then, hope you have a great week!

Stay connected! Follow us on @NomiSuite for the latest Nomi news and updates.

Facebook: https://www.facebook.com/nomisuite/

LinkedIn: https://www.linkedin.com/company/nomisuite

Instagram: https://www.instagram.com/nomisuite/

Twitter: https://twitter.com/NomiSuite

Want to find out more?

Book a free 30-day trial or talk to one of our advisor and see how our accounting software can help you manage staff, increase profitability and take your practice to the next level.

How to Prepare Your Business for Making Tax Digital

Making Tax Digital (MTD) is a new government rule that changes how businesses and landlords...

Read More

Prepare Year-End Accounts for Your Small Business

Year-end accounts are an important part of running a small business in the UK, providing...

Read More

How to Claim Corporation Tax Reliefs and Deductions

Corporation tax is a tax that companies and certain organisations pay on their profits during...

Read More

Nomi Cash Advance: Fast, Flexible Funding for Small Businesses and Accountants

Nomi Cash Advance helps small businesses manage cash flow by providing fast access to working...

Read More