Nomi Final Accounts & Corporation Tax Demo

Welcome to our deep corporation tax and Nomi final accounts tutorial! We’ll walk you through the complexities of utilizing Nomi software to manage final accounts and corporate tax requirements in this comprehensive demo. It is essential to comprehend these procedures whether you work as an accountant, a business owner, or in finance to guarantee compliance and maximize financial management.

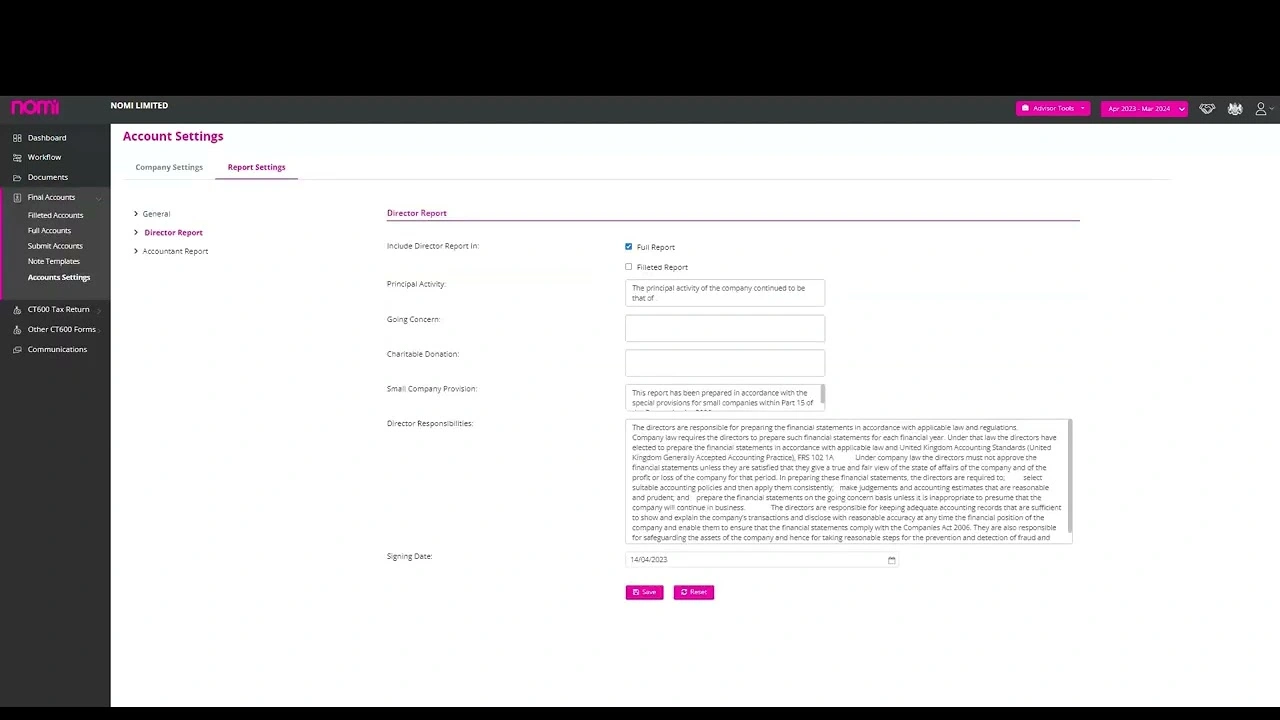

We’ll go over everything in this video, including how to set up your Nomi account, create final accounts, and easily file company tax reports. You’ll discover how to effectively use the Nomi interface’s robust capabilities to expedite your accounting operations.

Highlights Consist of:

- Overview of Nomi: Learn about the main features and user interface of the program.

- Configuring Your Nomi Account: Detailed instructions for setting up your account to run as efficiently as possible.

- Managing Final Accounts: Discover how to quickly and easily create balance sheets, profit and loss statements, and cash flow statements as well as other comprehensive final accounts.

- Calculating Corporation Tax: Recognize the complexities involved in accurately determining corporate tax liabilities using the Nomi platform.

- Filing Corporation Tax Returns: Learn how Nomi can speed up the filing process for corporation tax returns, saving you time and guaranteeing that all tax laws are followed.

Whether you’re a beginner trying to improve your accounting skills or an experienced professional trying to optimize your process, this demo will provide you with the know-how and resources you need to become an expert in Nomi Final Accounts & Corporation Tax. Watch now to advance your accounting and avoid missing out on optimizing your accounting processes!

For more information visit:

https://nomi.co.uk/what-we-do/final-accounts-corporation-tax-software-for-accountants-bookkeepers/

#Nomi #FinalAccounts #CorporationTax #AccountingSoftware #Taxation #FinancialManagement #AccountingTools #TaxCompliance #FinanceDemo #SmallBusiness #Entrepreneurship #FinancialReporting #TaxReturns #AccountingSolutions

Want to find out more?

Register for a free 14-days trial or book a 1:1 demo and see how Nomi's cloud-based accounting software could help you grow your practice, become more profitable and manage your staff.

How to Submit an Employer Payment Summary (EPS) to HMRC

EPS stands for Employer Payment Summary. It is a form that employers use to report...

How to File Final Accounts to HMRC and Companies House

Final accounts are an important part of a company's financial reporting process, providing a comprehensive...

How to Apply for a UTR Number | Complete Guide to UTR Number

UTR, or Unique Taxpayer Reference, is a 10 digit number issued by HM Revenue and...

Basis Period Reform

Dear Nomi Partners, We are pleased to introduce a significant change in UK tax reporting:...